Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. There is no requirement of maintaining Books of Accounts as per section 44AA and get it audited as per section 44AB of the assessee declares income on Presumptive basis.

Malaysia Tax Incentives Included In Economic Package Kpmg United States

These are the numbers for the tax year 2020 beginning January 1 2020They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them hereThese.

. Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. Deduction of business expenses shall not be allowed as it is assumed that all the deductions are included as only 50 of the total gross receipts are taken for tax purposes. A tax deduction reduces the amount of your aggregate income which the sum of your total income for the year put together.

DTDi supports activities across key stages of a companys overseas growth journey including. Page 1 of 32. The list goes as follows.

Malaysia Income Tax Deduction YA 2019 Explained. Deduction Claim By Employers 31 12. Taxability and Deductibility of Foreign Currency Exchange Gains and Losses In order to determine whether a business entity is subject to tax on its foreign.

Therefore there is neither an exchange gain nor loss for ABC Sdn Bhd. Updates and Amendments 32 13. Getting A Tax DeductionTax Incentive For Your Company.

Single Sign On What is this. According to the Income Tax Act 1961 Section 80CCF both the HUF Hindu Undivided Families and non-HUF members are now eligible to enjoy the tax benefits of subscribing to the infrastructure bonds for the long term. 32019 of Inland Revenue Board of Malaysia.

Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions. If your organisation has done so you can log on here using the credentials provided to you by your organisation. In 2019 that trend continued as Malaysias GDP reached an estimated 3653 billion with 43 growth.

19 November 2019 attitude she often receives tips from customers who patronise the restaurant. Under this section the citizens can claim a deduction of up to Rs. Some organisations have joined IBFD in an Identity Federation.

For income tax filing in the year 2020 YA 2019 you can deduct the. 1562019 but if the exchange rate on 1562019 was RM420 USD1 again the RM equivalent for UDS10000 was RM42000. Companies planning to expand overseas can benefit from the Double Tax Deduction Scheme for Internationalisation DTDi with a 200 tax deduction on eligible expenses for international market expansion and investment development activities.

In Section 80E of Income Tax Act 1961 it is mentioned that this education loan should be taken from a charitable or financial institution. The education loan that one takes on behalf of hisher children spouse students for whom heshe is a legal guardian or adopted children is applicable to get deduction under Section 80E. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No.

52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Monthly tax deductions in Malaysia are governed by the STD mechanism - which reduces the need for employees to pay tax in one lump sum. This initiative has been declared by the government.

Monthly Tax Deduction MTD 31 11.

How Will Future Taxes Affect Your Money

What Is Chargeable Income Plctaxconsultants

Latest News Chartered Accountant Latest News Accounting

What Is Chargeable Income Plctaxconsultants

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Nurse Salary What Do Nurses Earn Healthtimes

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysian Supplements Policy Trade Body Madsa Calls For Sales Tax Removal And Less Stringent Rules For New Formulations

What Can You Claim For Tax Relief Under Medical Expenses

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

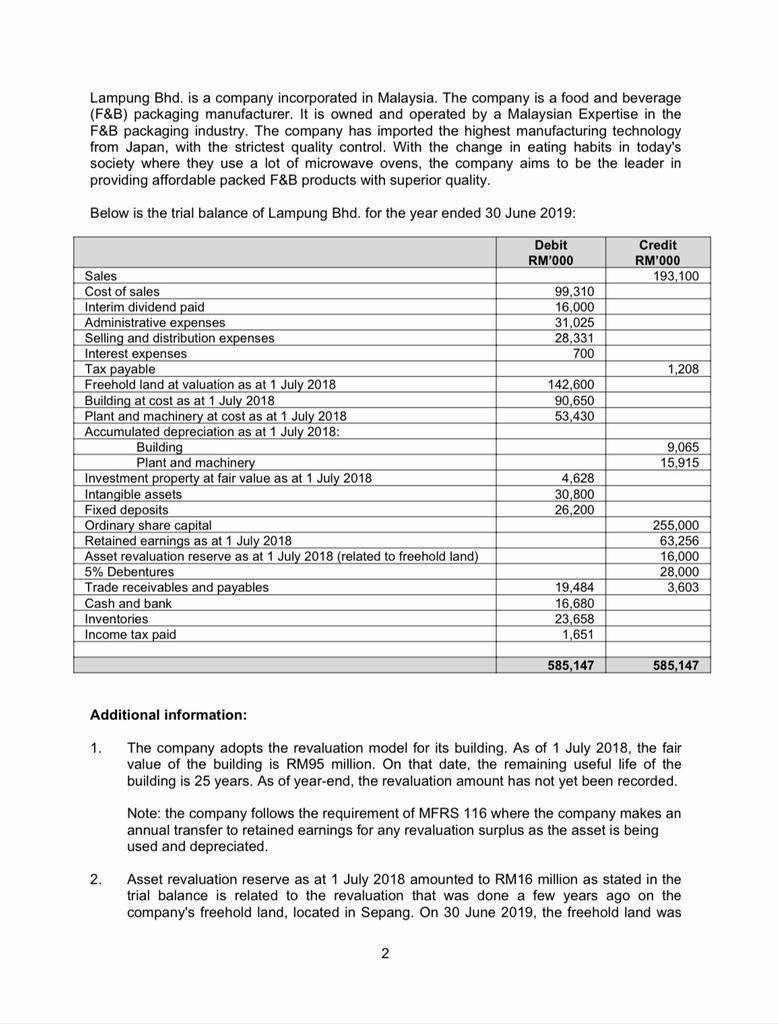

Lampung Bhd Is A Company Incorporated In Malaysia Chegg Com

Double Deduction On Expenses Incurred To Conduct Protege Rtw Programme Ey Malaysia

/ScreenShot2021-04-19at1.24.46PM-a91a290a658f4b9e9a47233faa19369d.png)

The Formula For Calculating Ebitda With Examples

:max_bytes(150000):strip_icc()/ScreenShot2021-04-19at1.24.46PM-a91a290a658f4b9e9a47233faa19369d.png)

The Formula For Calculating Ebitda With Examples

Malaysia Tax Incentives Included In Economic Package Kpmg United States

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

:max_bytes(150000):strip_icc()/ScreenShot2021-04-19at3.42.47PM-a84de3e70e844781a4f1f0a16ad7049a.png)

The Formula For Calculating Ebitda With Examples